Category: Business, Economics and Finance / Currency / Markets / Oil and Gas / Mining Industry

Share market surges despite series of poor company announcements

Thursday, 4 Feb 2016 15:18:41 | Justine Parker

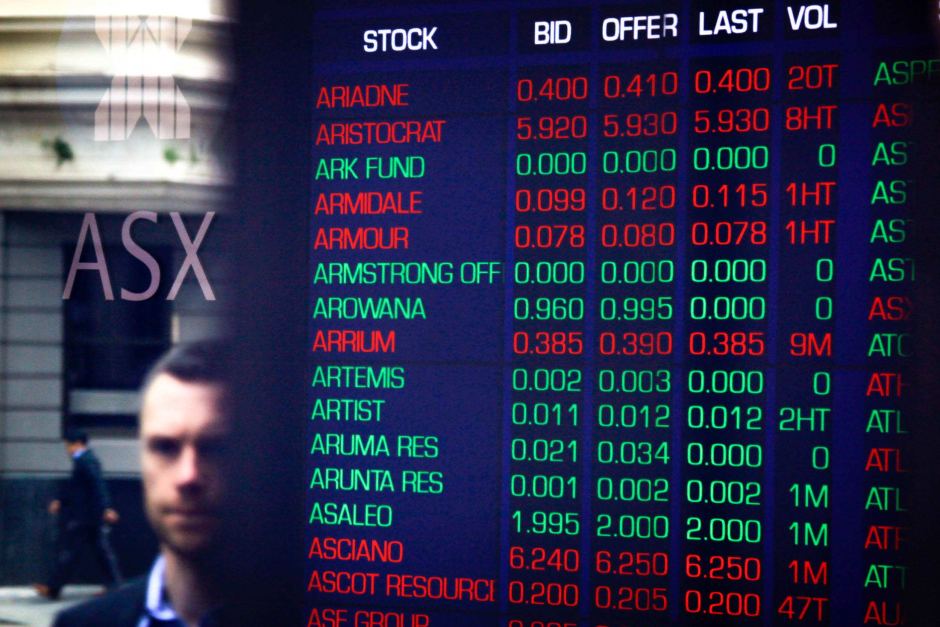

Pedestrians are reflected in the window of the Australian Securities Exchange (ASX) next to a board displaying stock prices in Sydney on September 24, 2014. (Reuters: David Gray)

A surge in oil prices and gains for Chinese stocks has driven a rally of Australian stocks, despite some disappointing company announcements.

The All Ordinaries index jumped by 99 points to close at 5,029, while the ASX 200 index soared by 2.1 per cent to finish on 4,980.

BHP Billiton rallied 8.3 per cent to $15.45 and its spin-off company South32 jumped 14.2 per cent to close at $1.09.

South32 flagged today that it was expecting to slash around 620 jobs and write down assets at its manganese business in South Africa by $US1.7 billion.

It also said it planned to slash costs at operations in Australia, which may result in more job cuts.

The big banks were also strong, led by Westpac on a gain of 3.6 per cent to $30.48.

Macquarie Group went the other way though, falling by 5 per cent to $64.86 after reporting a fall in net profits in the December quarter.

AGL Energy touched an all-time high after announcing plans to sell its gas exploration and production assets, blaming market volatility. It closed up 2.2 per cent at $18.91.

Meanwhile, gloves and condoms maker Ansell slumped 20.6 per cent to $14.80, touching a near three-year low after cutting its full-year profit forecasts after weaker-than-expected sales last month.

Over the day, the dollar held to its overnight gains against a weakened greenback, on expectations the US Federal Reserve would delay future interest rate rises.

That saw the US dollar post its biggest one-day drop in seven years.

Just before 4:00pm (AEDT), the Australian dollar was buying 71.7 US cents, 64.7 euro cents, 84.6 Japanese yen and 49.3 British pence.

At the same time, West Texas crude was higher at $US32.24 a barrel and Tapis crude was buying $US36.07 a barrel.

Spot gold was fetching $US1,143 an ounce.

- About Us

- |

- Terms of Use

- |

-

RSS

RSS - |

- Privacy Policy

- |

- Contact Us

- |

- Shanghai Call Center: 962288

- |

- Tip-off hotline: 52920043

- 沪ICP证:沪ICP备05050403号-1

- |

- 互联网新闻信息服务许可证:31120180004

- |

- 网络视听许可证:0909346

- |

- 广播电视节目制作许可证:沪字第354号

- |

- 增值电信业务经营许可证:沪B2-20120012

Copyright © 1999- Shanghai Daily. All rights reserved.Preferably viewed with Internet Explorer 8 or newer browsers.

Send to Kindle

Send to Kindle