Category: Business, Economics and Finance / Markets / Stockmarket

ASX admission changes would have 'undue impact' on nascent businesses

Thursday, 30 Jun 2016 14:03:52 | Thuy Ong

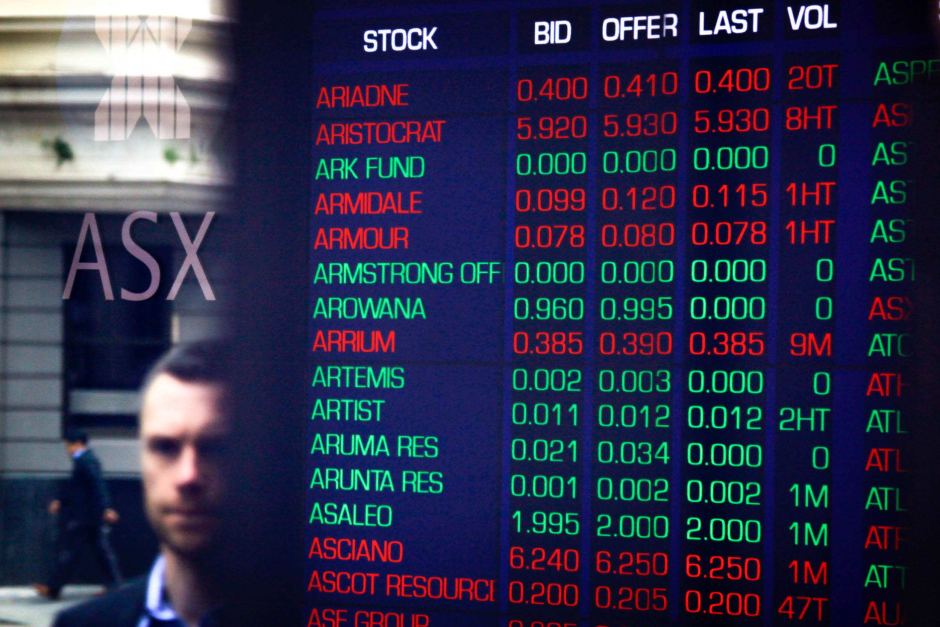

The ASX said it would consider the views of stakeholders in forming new admission requirements. (Reuters: David Gray)

A group of 15 broking, law and advisory firms say they are concerned about some of the proposed changes to the ASX's listing rules.

In a joint statement, the firms and 115 co-signatories said the changes to increasing the net tangible asset criteria from $3 million to $5 million, requiring three full financial years of audited accounts and suspending companies announcing backdoor listings would have "undue impact on early stage businesses".

Backdoor listings refer to reverse takeovers, where a privately held company that may not qualify for an IPO purchases a publicly traded company or a shell company.

The firms, which include Argonaut, Patersons Securities, FTI Consulting, Bellanhouse Legal and DLA Piper, said despite the concerns, they agreed with the majority of ASX's other proposed suggestions including a minimum free float condition, increasing the profit test, spread threshold and working capital criteria.

"As a group, we are very supportive of the efforts of the ASX to maintain market integrity and we can see that's the position they are coming from with their proposed changes," said Argonaut managing director Eddie Rigg on behalf of the group.

The Group suggests, instead, the ASX should maintain net tangible asset criteria at $3 million for mining and resource exploration companies, limiting full financial audited accounts, and avoiding the need for suspension immediately upon announcement of backdoor listings.

In response to questions put forward by the ABC, a spokesperson for the ASX said it had met with a number of stakeholders as part of the consultation process.

"ASX will consider the views of a range of stakeholders, including listed companies, stock brokers, investment banks, investor groups, industry organisations and the regulator in formulating the final new admission requirements," Matthew Gibbs, general manager of media and communications at ASX said.

"The proposals are designed to maintain and strengthen the quality and integrity of the ASX listings market. This is in the interests of all market users and includes dealing with the issue of companies seeking to come to the public market too early in their lifecycle."

Backdoor listing suspensions are already in place, and the ASX said it prevents "potential mischief" and only enables companies to trade "if and when they have met ASX's admission and quotation requirements".

ASX said new admission requirements will be publish once concluded, while the consultation paper is available online.

- About Us

- |

- Terms of Use

- |

-

RSS

RSS - |

- Privacy Policy

- |

- Contact Us

- |

- Shanghai Call Center: 962288

- |

- Tip-off hotline: 52920043

- 沪ICP证:沪ICP备05050403号-1

- |

- 互联网新闻信息服务许可证:31120180004

- |

- 网络视听许可证:0909346

- |

- 广播电视节目制作许可证:沪字第354号

- |

- 增值电信业务经营许可证:沪B2-20120012

Copyright © 1999- Shanghai Daily. All rights reserved.Preferably viewed with Internet Explorer 8 or newer browsers.

Send to Kindle

Send to Kindle