Category: Business, Economics and Finance / Company News / Globalisation - Economy / Markets / Stockmarket / Futures / Currency

Australian shares rise to fresh 11-month high

Wednesday, 20 Jul 2016 15:53:30 | Thuy Ong

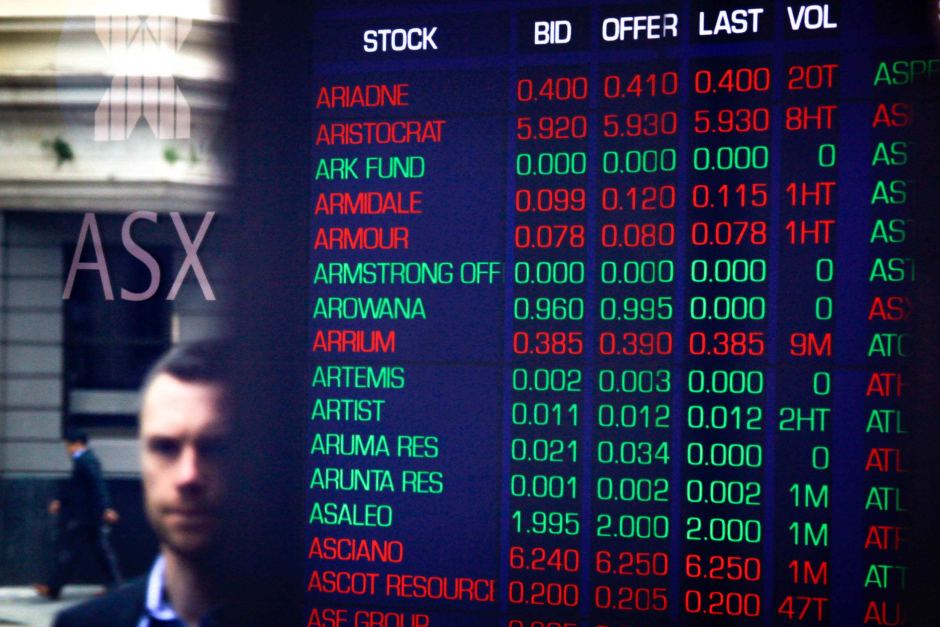

Australian shares have finished higher, with the Big Four banks all rising. (Reuters: David Gray)

The Australian share market has risen to close at fresh 11-month highs, supported by major banking and health stocks.

Markets at 5:25 pm (AEST)

- ASX 200 +0.7 pc to 5,489, All Ords +0.6 pc to 5,566

- Biggest gains: REA Group +2.9 pc to $64.81, Sydney Airport +2.9 pc to $7.36, Ramsay Health +3.3 pc to $76.59

- Biggest losses: CIMIC -19 pc to $26.96, BHP Billiton -2.9 pc to $19.25, St Barbara -3.5 pc to $3.31

- Futures trade: Euro STOXX 600 +0.3 pc to 336.7, FTSE +0.1 pc to 6,652 S&P 500 +0.1 to 2,160

- AUD: 74.8 US cents, 57.2 British pence, 79.4 Japanese yen, 68.1 euro cents, $NZ1.063

The Big Four banks all rose, with Westpac leading, jumping 1.2 per cent, while Commonwealth Bank of Australia gained 1 per cent to 1-1/2 month highs of $76.76.

Among health stocks, CSL climbed 2.1 per cent, while Mesoblast jumped 1.8 per cent.

Other blue chip stocks also supported the broader market, with Telstra up 0.9 per cent, while Wesfarmers gained 1.4 per cent.

Miners were the only drag on the market, with Rio Tinto losing 2 per cent to two-week lows of $48.

BHP Billiton dumped 2.9 per cent. Earlier today, the iron ore miner said record annual iron ore production in Western Australia had offset a drop in output in Brazil because of the Samarco mine disaster. Mining remains suspended at Samarco.

CIMIC crashed 19 per cent to $26.96. Despite a 3 per cent increase in net profit to $265 million over the same time last year, brokers were deeply disappointed with the quality of the construction and engineering company's result.

Elsewhere, the International Monetary Fund trimmed its global growth forecast on the political and economic uncertainty generated by Brexit.

Meanwhile, a new Household, Income and Labour Dynamics in Australia Report showed the chances of owning a home are slipping for many Australians, finding that soon, fewer than half of adults will own their own home.

In commodities trade, spot gold has slipped to $US1,329 an ounce, while West Texas crude is buying $US44.59 a barrel.

- About Us

- |

- Terms of Use

- |

-

RSS

RSS - |

- Privacy Policy

- |

- Contact Us

- |

- Shanghai Call Center: 962288

- |

- Tip-off hotline: 52920043

- 沪ICP证:沪ICP备05050403号-1

- |

- 互联网新闻信息服务许可证:31120180004

- |

- 网络视听许可证:0909346

- |

- 广播电视节目制作许可证:沪字第354号

- |

- 增值电信业务经营许可证:沪B2-20120012

Copyright © 1999- Shanghai Daily. All rights reserved.Preferably viewed with Internet Explorer 8 or newer browsers.

Send to Kindle

Send to Kindle