Category: Business, Economics and Finance / Mining Industry / Stockmarket

BHP credit rating takes a slide amid commodities price crunch

Tuesday, 2 Feb 2016 04:20:55 | Peter Ryan

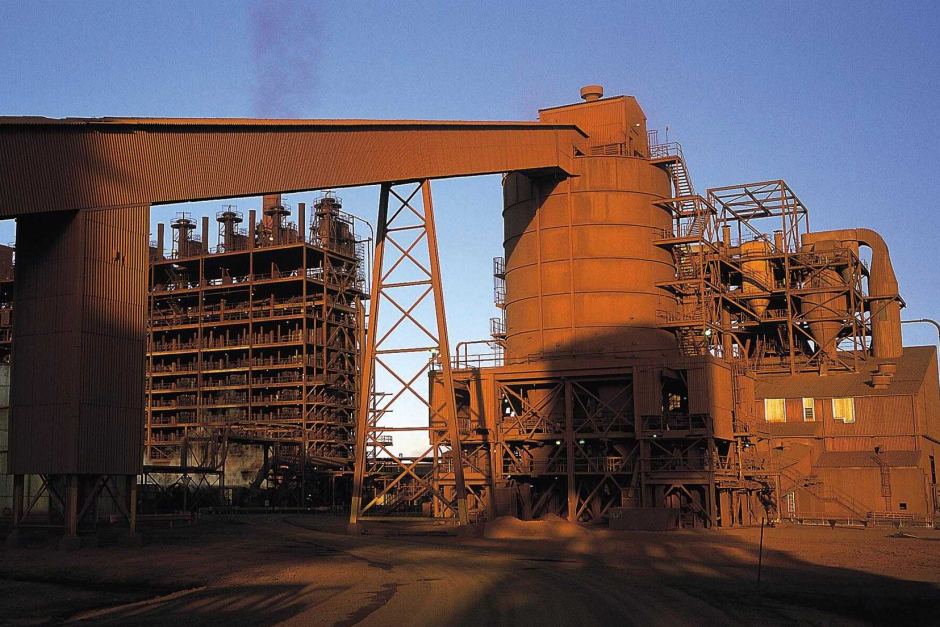

Mining company BHP Billiton is struggling to maintain its progressive dividends to shareholders in the face of falling commodity prices. (AAP)

The commodities crunch has dealt a serious blow to the credit risk profile of BHP Billiton and other resources firms.

Key points

- BHP Billiton credit rating lowered from A+ to A by S&P

- Rio Tinto's A- rating placed on a negative watch by S&P

- Analysts warn that BHP Billiton's dividend payments likely to fall later this year

Ratings agency Standard & Poor's has downgraded BHP's credit rating from A+ to A to reflect changes forecast for commodity prices.

In a statement, Standard & Poor's said the decision reflected "very challenging market conditions and increased demand uncertainty over the coming years".

"Metal prices have come under pressure because of fears of lower demand from China, and excess supply remains an issue," S&P said.

"Particularly relevant for BHP Billiton, the oversupply of crude oil in the market results in very weak oil and gas prices, which we now believe will last over the foreseeable future, putting further pressure on its balance sheet."

S&P has also placed BHP on "credit watch with negative implications", and has signalled the miner's rating could be taken a notch lower after it releases its earnings on February 23.

BHP's main rival, Rio Tinto, has also seen its credit rating placed on a negative watch, with S&P warning that it faces a one-notch downgrade from A- if it does not move quickly to sure up its balance sheet amid weak commodity prices.

BHP responded to the downgrade saying it had "the strongest credit rating in the sector and remains committed to maintaining its strong balance sheet through the cycle".

BHP dividends threatened by commodity price slump

The S&P downgrade comes as BHP struggles to maintain its progressive dividends to shareholders in the face of global turmoil and falling commodity prices.

The progressive dividend policy promises to pay shareholders the same or bigger dividends in each half-year period.

BHP chairman Jac Nasser late last year refused to guarantee the progressive dividend would survive, but said it was an "important distinguishing feature" for the company.

Fat Prophets analyst David Lennox said the end of the policy seems unlikely at the half-year results this month, but possible when the full-year profit is unveiled in August.

"We certainly think that for the half year they will certainly, probably, pay out half of last year's full-year dividend and then we would expect that, perhaps at the full-year results come August, that the company would then look at what it will do going forward in terms of dividends," he said.

"As a price taker, it may not now continue to hold to a progressive dividend, but perhaps may go to a percentage on underlying profit - that does mean that dividends may become a little variable."

BHP maintains an A+ credit rating at Fitch Ratings and an "A1" assessments at Moody's, which has the miner on review for a downgrade.

The miner's shares have plunged as result of the commodities crunch and fears about China's economy.

BHP shares were down 0.5 per cent at $15.18 by 10:25am (AEDT).

- About Us

- |

- Terms of Use

- |

-

RSS

RSS - |

- Privacy Policy

- |

- Contact Us

- |

- Shanghai Call Center: 962288

- |

- Tip-off hotline: 52920043

- 沪ICP证:沪ICP备05050403号-1

- |

- 互联网新闻信息服务许可证:31120180004

- |

- 网络视听许可证:0909346

- |

- 广播电视节目制作许可证:沪字第354号

- |

- 增值电信业务经营许可证:沪B2-20120012

Copyright © 1999- Shanghai Daily. All rights reserved.Preferably viewed with Internet Explorer 8 or newer browsers.

Send to Kindle

Send to Kindle