Category: Budget / Government and Politics / Banking / Federal Government / Federal Parliament / Business, Economics and Finance

'They already don't like you very much': Morrison asks banks not to pass on levy

13:06 UTC+8 May 10, 2017 | Henry Belot And Peter Ryan

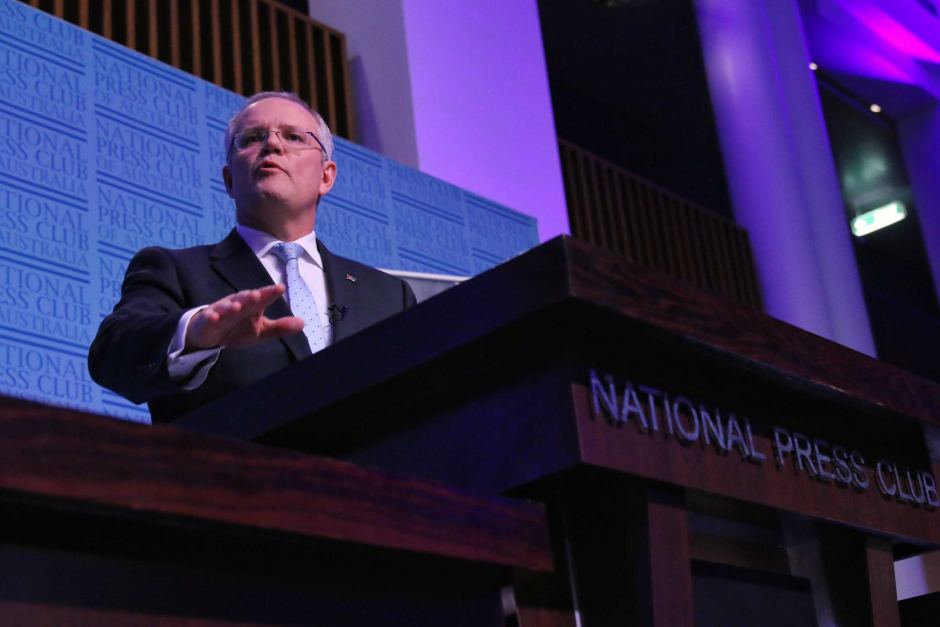

Scott Morrison addressed bankers at the National Press Club today. (ABC News: Nick Haggarty)

Treasurer Scott Morrison has pleaded with Australia's biggest banks not to pass the cost of a new tax onto customers, telling executives the public "already don't like you very much".

The levy will raise $6.2 billion over four years but has been slammed as a "very bad idea" by David Murray, the head of the Government's financial system inquiry.

Speaking at the National Press Club, Mr Morrison said if banks wanted to show they valued their customers, then they would not charge higher fees.

"Don't do it — they already don't like you very much," he said.

"Prove them wrong, don't confirm their worst impressions. Tell them you will pony up and help fix the budget."

Mr Murray warned banks would be tempted to pass on the cost of the levy to borrowers, possibly resulting in an interest rate rise of as much as 20 basis points.

"If the banks pass this on, the Treasurer has just tightened monetary policy by 12 to 25 basis points and the sectors most at risk are housing borrowers and small and medium enterprises," Mr Murray told the ABC.

Commonwealth Bank flags levy could be passed on

In a statement, Commonwealth Bank chief executive Ian Narev said he would seek more information from Treasury about the tax, but indicated it could be passed on.

"As every business owner or employee knows, every extra cost needs to be borne by customers or shareholders or a combination of both," he said.

Westpac chief executive Brian Hartzer made it clearer in a statement issued this afternoon saying: "the cost of any new tax is ultimately borne by the shareholders, borrowers, depositors and employees".

Australian Bankers' Association chief Anna Bligh said the biggest banks would need to make up the shortfall somehow, flagging potential fee increases.

The payments have been billed as a fair contribution that may create a more level playing field for the banking sector and encourage greater competition.

The banking sector will also face higher fines should executives breach misconduct laws, ranging from $50 million for small banks to $200 million for larger banks.

"For the system to be fairer there needs to be greater competition and accountability — now," Mr Morrison said.

Business Council of Australia chief executive Jennifer Westacott said the levy was a poor policy precedent and the Coalition risked mirroring Labor's ultimately failed tax on mining companies.

She also warned that despite assurances from Mr Morrison, banks would find a way to pass the levy on to shareholders, customers and ordinary borrowers.

"It just doesn't make sense," Ms Westacott said.

"They either have to be paid for by lower dividends for shareholders, many of whom are mum and dad investors, or there have to be lower dividends to the big superannuation organisations.

"Eventually this finds its way back into the broader economy. Where does this stop?"

More stories:

- Explore the winners and losers

- See where every dollar comes from, and how it's spent

- Read a wrap of what Scott Morrison's announced

- Find out why the big banks will wear the brunt of the budget balancing act

- Read analysis on the strangely Labor budget from Ian Verrender and Stephen Long

- See what Michael Janda thinks of the housing affordability measures

- Read why Annabel Crabb thinks Malcolm Turnbull is a Mr Fix-it

- Just want the quick facts? This cheat sheet is for you

- About Us

- |

- Terms of Use

- |

-

RSS

RSS - |

- Privacy Policy

- |

- Contact Us

- |

- Shanghai Call Center: 962288

- |

- Tip-off hotline: 52920043

- 沪ICP证:沪ICP备05050403号-1

- |

- 互联网新闻信息服务许可证:31120180004

- |

- 网络视听许可证:0909346

- |

- 广播电视节目制作许可证:沪字第354号

- |

- 增值电信业务经营许可证:沪B2-20120012

Copyright © 1999- Shanghai Daily. All rights reserved.Preferably viewed with Internet Explorer 8 or newer browsers.

Send to Kindle

Send to Kindle